@Pixabay.

@Pixabay.

Insurers’ exposure to private credit has exploded over the past couple of decades. According to the Mercer and Oliver Wyman 2024 Global Insurance Investment Survey, 73% of insurers already invest in private markets or plan to do so in 2024, continuing the trend seen in the 2023 survey.

Moreover, that trend is set to continue in the long run, according to analysis by Moody’s. The ratings agency found that almost 80% of insurers plan to increase their holdings of at least one class of private credit over the long term.

“Private credit offers a yield spread, or an illiquidity premium relative

to an equivalent credit quality in public markets."

The continuing allure of private credit to insurers reflects two intrinsic features of the asset class, said Mark Meiklejon, Head of Private Market Investment Specialists at Aviva Investors. Those features are the ability to generate returns over and above those available in public markets, and diversification:

“Private credit offers a yield spread, or an illiquidity premium relative to an equivalent credit quality in public markets, and access to certain sectors that are difficult to access in public credit markets,” Meiklejon said.

In terms of current positioning, Oliver Little, Head of UK Insurance Solutions at the investment management firm Neuberger Berman, said that insurers are focusing on two issues: expected interest-rate cuts, and the late stage of the credit cycle.

Little said that the prospect of rate cuts means insurers are taking longer duration positions in the public fixed-income portion of their portfolios, while locking in fixed coupons in their private credit portfolios. Meanwhile, he argued that the majority of private credit managers have yet to experience the end of a credit cycle and thus the quality of their underwriting, covenants and workout teams is untested.

“To paraphrase Warren Buffet,” said Little, “the end of the credit cycle will reveal who has been swimming naked when the tide goes out. Having allocated significantly to private credit over the last decade or so, insurers now have to consider how they protect themselves in the event of a severe default cycle.”

That view echoes warnings by the IMF in April that the rapid growth of “this opaque and highly interconnected segment of the financial system could heighten financial vulnerabilities given its limited oversight”.

To counter these risks, said Little, insurers are currently adjusting their private credit portfolios in two main ways. Firstly, they are increasingly looking to investment-grade private fixed-income markets to improve the quality of their private credit allocations. Little viewed asset classes such as US private placements, European investment-grade private loans, asset-backed lending and residential mortgage loans as a means of improving credit quality while maintaining a solid illiquidity premium.

Secondly, insurers are looking to diversify away from what has become a core allocation in their illiquid portfolios (direct lending), into other private-credit asset classes that are uncorrelated with corporate credit. The latter include asset-backed lending – and other asset classes underpinned by consumer risk, rather than corporate risk, are increasingly a part of the conversation.

Laura Parrott, Head of Private Fixed Income at the US asset manager Nuveen, also said that increasing duration is currently the most popular course of action among insurers.

She cited Nuveen’s Equilibrium 2024 survey of institutional investors, which found that 61% of North American insurers, along with 58% of those in Asia Pacific and 53% in Europe, planned to extend duration.

Parrott added that while it’s not surprising that insurance companies are looking to capitalise on ways to lock in higher rates and match long-term liabilities, the investment choices used to express this view are unexpected. They involve two lesser-known but innovative debt instruments: Commercial Property Assessed Clean Energy (C-PACE) and credit tenant loans; and US municipal bonds, which are often an overlooked means of extending duration.

"The quality of the sponsor and the quality of the actual borrower

is always critical at any point in the cycle."

An increasing number of insurance companies are also planning or reserving allocations for opportunistic investments to capitalise on any negative surprises that result in heightened market volatility, according to Marc Lickes, Managing Director of investment firm StepStone’s Private Debt group. He believed that this trend has been driven by the positive experiences of tactical trades during the COVID-19 pandemic and the 2022 market downturn, both of which saw rapid recoveries.

Providing some words of reassurance about the prospect for corrections, Meiklejon pointed out that there’s always risk, and the key is the quality of the lending insurers make. “It's not just about getting exposure to the yield profiles; the quality of the sponsor and the quality of the actual borrower is always critical at any point in the cycle,” he said.

Parrott also stressed the importance of quality, explaining that while concerns about a full-blown recession have subsided somewhat, the higher rate environment will mean that any economic slowdown will be more painful for investors, placing a greater emphasis on quality.

“When building a private debt portfolio for our clients, we aim to diversify

across at least 200 borrowers and eight general partners."

Continued geopolitical instability in different regions is an added complication, said Parrott. She pointed out that the Middle East has been at the forefront in the first half of 2024, as Israel’s conflict with Palestine and Iran has threatened to unravel further. Elsewhere, Russia’s invasion of Ukraine continues to weigh heavily on Europe.

Given the uncertain background, diversification is critical, said Lickes. “When building a private debt portfolio for our clients, we aim to diversify across at least 200 borrowers and eight general partners (GPs), while also cutting riskier transactions with high leverage and loan-to-value (LTV) ratios.”

However, he added that many insurance companies, especially life insurers, are well-positioned to handle illiquidity and can benefit from the additional risk premiums that private debt offers.

He also argued that during recent periods of market turmoil, private debt has shown remarkable resilience and has outperformed its public counterparts, hence why it is often referred to as an “all-weather strategy”.

Looking to the future, there is a general consensus that insurers will continue to build exposure to private credit as the sector grows. Meiklejon anticipates that traditional lenders will continue to rein in their activity and that institutional private capital will continue to fill the gap.

“As the market continues to develop and more asset classes become available, we just think even longer term we will see more and more private capital and private debt”, Lickes said.

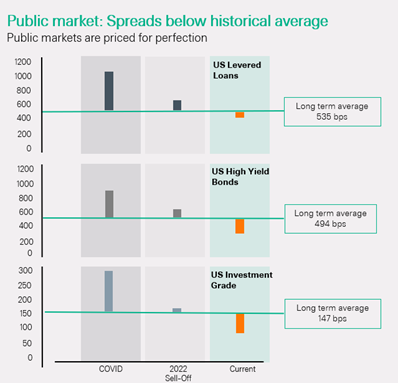

He added that while the shift towards private debt slowed in 2022 and at the beginning of 2023, due to the higher risk-free rate and the emergence of alternative options in the public space, this trend has now reversed. That reflects the compression of spreads and their return to levels below long-term averages, coupled with the relatively higher spreads in private debt.

"I expect … investment-grade private credit to become a larger

allocation for insurance companies."

Parrott also foresees investment-grade private credit becoming an increasingly large allocation for insurance companies and an area of heightened interest from consultants as they formulate advice for their clients. Over the past couple of years, Parrott said they have seen a significant increase in focus on private credit by both asset managers and insurance investors alike as investors have sought increased relative value, portfolio diversification, and structural protections, particularly in the more complex segments of the market.

This, she said, has been partially driven by a pullback in lending by banks, allowing asset managers to step in and help fill that role for issuers. But it is also due to a heightened focus on the space by asset managers. "I expect both of these trends to continue, and for investment-grade private credit to become a larger allocation for insurance companies and an area of heightened interest from consultants as they formulate advice for their clients."

Little is also certain that insurers will continue to expand their investment universe, within the bounds of their regulatory environment. He said that insurers were forced to search for yield away from public fixed portfolios during the Zero Interest Rate Policy (ZIRP) era, which involved a trade-off between illiquidity and credit quality, meaning that they have become more comfortable with the risks associated with private markets. "Consequently, they are now more sophisticated and have investment teams who understand private markets far better than previously," he said.

It is also clear that, with banks stepping back from capital markets, private funding will not only remain but grow as a percentage of the capital markets.

At the same time, the investment opportunity set is expanding, and insurers have access to better data on the behaviour of different asset classes.