@Swiss Re.

@Swiss Re.

Global inflation risk is rising fast. While we see the surge of CPI as temporary, the risk of higher inflation in the longer term has increased notably.

Our forecasts for real GDP in major global economies are unchanged. We have revised up our forecasts for US and euro area CPI.

We expect the Fed to taper asset purchases sooner than previously thought, but that interest rates will remain low.

The global economy is on track for a strong recovery continuing to benefit from the lifting of restrictions as vaccination rollout programmes progress.

The composite Purchasing Managers' Index (PMI) in the US and EU reached record highs in May, driven by recovery in the services sectors.

However, growth paths are diverging across markets: momentum in China's economy has moderated recently after the return to pre-COVID levels of output last year. In the US, meanwhile, massive fiscal stimulus should continue to support demand as the economy continues to open up more.

The euro area continues to lag, and we expect a notable pick-up in growth from the second quarter onwards only.

Inflation pressures are rising fast

In the US, CPI surged to 5.0% y-o-y in May; in the UK it nearly doubled to 1.5% y-o-y in April.

We have revised up our 2021 forecasts, in the US to 2.9% (vs 2.5%), and in the euro area to 1.7% (vs 1.5%), based mostly on the base effect of last year's low oil prices and supply shortages.

The market's expectation of average US inflation over the next 10 years has not increased as much as breakeven rates suggest, and is returning to pre-pandemic levels.

The strong gain in breakeven rates from last year's lows is largely due to the collapse in the liquidity premium.

In China, meanwhile, CPI remains largely muted (May: +1.3%) owing to falling meat prices and after last year's high CPI base level.

On aggregate, we maintain that a surge in global inflation will be temporary but that the risk of higher inflation has increased.

Key to watch are wage pressures and economic overheating, particularly in the US.

Fed is expected to taper earlier given the risks of inflation upside potential and

overheating in the US

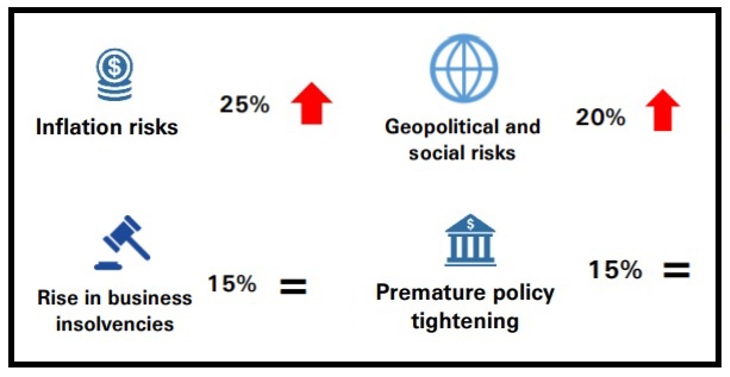

As a result, we have upgraded our inflation risk outlook to 25% from 20% last month.

Higher inflation could lead to earlier policy tightening: we now expect the Fed to start gradually tapering its asset purchases in the first quarter of 2022 (vs H2 2022 previously).

Even with inflation pressures, however, we expect the low interest rate environment to persist, given elevated debt levels, labour market slack and slowing growth as of H2 2021.

All told, persistent high inflation is a key risk to watch: rushed central bank tightening could generate more volatility in the financial markets and hurt the real economy.

We continue to see pandemic setbacks as the main near-term downside risk to global growth.

We continue to see pandemic setbacks as the main near-term downside risk to global growth.

The setbacks could include another surge in COVID-19 infections, slower than anticipated vaccine rollouts due to production or distribution bottlenecks, or new mutations that reduce the effectiveness of existing vaccines.

These risks could further delay economic recovery by causing tighter or extended lockdowns.

The severity of the current outbreaks in India and Brazil illustrates how quickly the outlook can turn negative.

Key to watch: COVID-19 infection rates, vaccination progress, virus mutations, stringency of restrictions.

We expect inflation to increase globally in 2021 due to base effects from low oil prices in 2020, larger-than-expected US fiscal stimulus, idiosyncratic supply shortages and increasing demand as re-opening progresses.

The market is paying increased attention to Fed policy guidance as it tries to weigh the nuances of its communication. Medium- and long-term inflation risks are tilted to the upside.

Key to watch: OPEC meeting (01 July); euro area HICP (17 June); US PCE (25 June); US CPI (10 June).

For a while, the pandemic appeared to have pushed geopolitical tensions into the background as countries grappled with the health crisis at home. However, tensions are coming back into the fray.

Russia's recent build-up of troops along its border with Ukraine, and breaches of international cybersecurity, as well as lingering disagreements between Iran and the US on nuclear matters, are among key recent developments.

Key to watch: Vienna nuclear talks, US-China trade disputes, income distribution data.

Public support measures have prevented an increase in business insolvencies so far, but these are likely to increase once those measures are phased out.

The depth of the COVID-19 crisis means insolvencies could rise by as much as during the global financial crisis of 2008-09.

Alternatively, the trend of "zombification" could lead to a delayed but sustained period of higher insolvencies if support measures are prolonged.

Key to watch: Business bankruptcies, credit spreads, restructuring/default rate news.

COVID-19 has increased levels of public debt to very high levels. As restrictions are eased and economies recover, governments may withdraw stimulus support or tighten policy prematurely, which could choke the upswing.

There is currently broad global agreement on the need of fiscal and monetary support, but consensus may not hold. In the US, both corporate and income tax hikes are under discussion.

Key to watch: Fiscal announcements, central bank speeches, US infrastructure package debate.

Growth could strengthen if vaccine rollout progresses faster than in than our baseline outlook, consumer spending is boosted by pent-up savings, and/or if the effectiveness of fiscal spending is greater than anticipated.

Growth could strengthen if vaccine rollout progresses faster than in than our baseline outlook, consumer spending is boosted by pent-up savings, and/or if the effectiveness of fiscal spending is greater than anticipated.

A resolution to the US-China trade disputes, with a roll back in tariffs would also be an accelerator.

Key to watch: Vaccination progress, fiscal spending plans, severity of lockdowns, PMIs, real interest rates, US-China trade and tech disputes