@Swiss Re.

@Swiss Re.

The spike in energy prices is providing fuel to the inflation fire, with stagflation risk rising further.

Soaring energy prices and prolonged supply-side cost pressures will keep inflation elevated for longer.

In Europe, year-over-year headline inflation rates will accelerate further from current levels before peaking this winter (at above 4% y/y in both the euro area and the UK).

We expect US inflation rates to remain elevated near current levels (latest US CPI print: 5.4% y/y), climbing even slightly higher this winter and only moderating more meaningfully after next spring.

We have subsequently raised our 2022 CPI forecasts for the US and euro area by 0.4 percentage points (ppt) to 3.3% and 2.1%, respectively, and for China by 0.2 ppt to 2.3%.

As with the US and UK, our 2022 euro area CPI forecast is now higher than the region's central bank target. While we do not believe this will prompt a regime shift in the "low for longer" yield environment, central banks are becoming more hawkish.

We now expect the Bank of England to hike twice in 2022. We also think the Federal Reserve will make a formal announcement on tapering asset purchases next month but will wait until 2023 to hike.

Meanwhile, the European Central Bank and PBOC will remain accommodative.

We have lowered our 2021 and 2022 real GDP expectations for the US to 5.5% (-0.5 ppt) and 3.7% (-0.3ppt), respectively; for the euro area to 4.8% (-0.1ppt) and 4.1% (-0.2ppt); and for China to 8% (-0.3ppt) and 5.1% (-0.2ppt).

The main reason is supply-side issues, as seen in raw materials and labour shortages in

various countries.

The energy crisis is also exerting negative growth effects. For example, several companies in China and the UK have had to down tools due to energy shortages.

Signs of slowing growth momentum are mirrored by the decline in the September composite PMIs in the US (55.0) and the euro area (56.2), although from elevated levels.

Note, while the risk of stagflation has risen, this is not our base-case scenario.

With the government's commitment to social equality, regulations have tightened, and this will likely continue over the next months in sectors like tech and real estate.

Yet managed restructurings/orderly bankruptcy of these companies are more likely, and we do not expect broad systemic risks to China's banking sector or financial stability.

Inflation pressures have risen due to the energy crisis and with global supply-side constraints lasting longer than anticipated.

Inflation rates will stay above the targets of central banks next year too. Central banks have limited ability to resolve this type of supply-driven inflation shock. Risks of policy mistakes have risen in this environment.

Key to watch: euro area HICP (20 October); US PCE (29 October); US CPI (10 November); OPEC meeting (4 November).

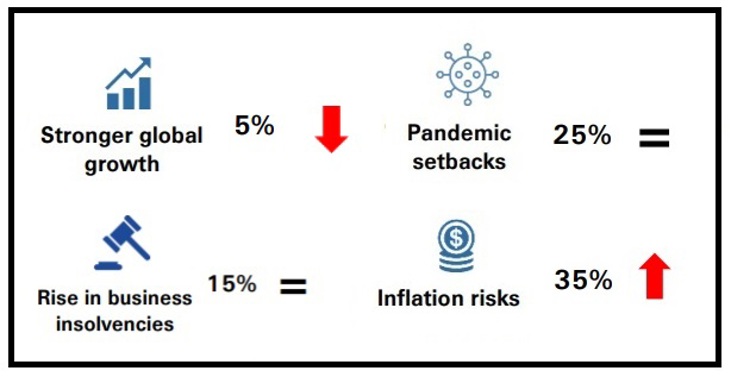

The peak of the latest COVID-19 wave is behind us, with new daily cases on a downtrend globally. However, risks for autumn/winter resurgences remain.

This could cause tightening in targeted restrictions, with political and public appetite for full lockdowns now much reduced.

The speed and scale of booster shot rollouts will also be critical, not least as further mutations could decrease vaccine effectiveness.

Key to watch: the mu variant and emergence of additional mutations (and possibly new variants), hospitalizations and deaths, vaccination rates and effectiveness, demand for booster shots, the stringency of restrictions, the persistence of cautious individual behaviours.

Geopolitical tensions remain with recent tensions between China and Taiwan in particular warranting attention.

The global energy crisis also contains a strong geopolitical element (eg, Nord Stream II pipeline running from Russia to Germany) as governments grapple and compete amid restricted supply security.

The crisis also risks reviving domestic social tensions with low-income households disproportionately hurt.

Key to watch: US-China disputes, economic sanctions, energy crisis knock-on implications, income distribution data.

Prolonged price pressures risk triggering a rise in long-term inflation expectations. This could force central banks to tighten monetary policy sooner and faster than currently expected, resulting in tighter financial conditions.

Several central banks across the globe have already begun to raise interest rates. With respect to fiscal policy, support is set to diminish in the coming years following the massive stimulus of 2020-2021.

Key to watch: Central bank speeches, policy moves, inflation expectations, further fiscal announcements particularly extra spending bills currently under negotiation in the US.

Public support measures have prevented an increase in business insolvencies so far, but these could increase as measures end and/or there is a sharp rise in debt servicing costs.

The trend of "zombification" could also lead to a delayed but sustained period of higher insolvencies if support measures are prolonged

Key to watch: Business bankruptcies, credit spreads, restructuring/default rate news, debt servicing costs (interest rates).

Growth could strengthen if vaccine rollout progresses faster in emerging markets and there is strong demand for booster shots in advanced markets, certain countries move away from their "Covid-zero" strategies, consumer spending is boosted by a faster drawdown of pandemic savings, and/or if the effectiveness of fiscal spending is greater than anticipated.

A resolution to the US-China trade disputes with a rollback in tariffs would also be an accelerator.

Key to watch: Vaccination progress, the severity of COVID-19 restrictions, fiscal spending plans, PMIs, consumption, real interest rates.