Summer has arrived, also for economic data. Looking ahead, the economic summer will be different than in past years with the structural repair remaining huge and the structural outlook weak.

The policy response from the EU has given ground for an upward revision of our Euro area 2021 outlook by 1ppt to 4.8 per cent.

We have also raised the projections for 10y German government bond yields from -0.6 per cent to -0.4 per cent for year-end 2020/21.

At the same time, the long delay in easing lockdown measures in the UK and weak economic momentum in Japan, have led us to downgrade our expectations for 2020 GDP growth to -8.5 per cent (-2 ppt) and -4.7 per cent (-0.7pp), respectively.

Overall, uncertainty around the outlook remains elevated and risks are tilted to the downside.

Economic activity has rebounded sharply as economies are re-opening.

Most governments in Asia, Europe and the US have eased virus containment measures significantly and economic data have surprised on the upside in June.

Global mobility has rebounded sharply, and our mobility-based SRI GDP shortfall index shows that most developed markets have returned to above 90 per cent of pre-crisis economic activity, with the GDP shortfall in G7 standing at around -7.5 per cent. (see Figure 1).

We expect the economy to improve further in 2H 2020, albeit at a slower pace.

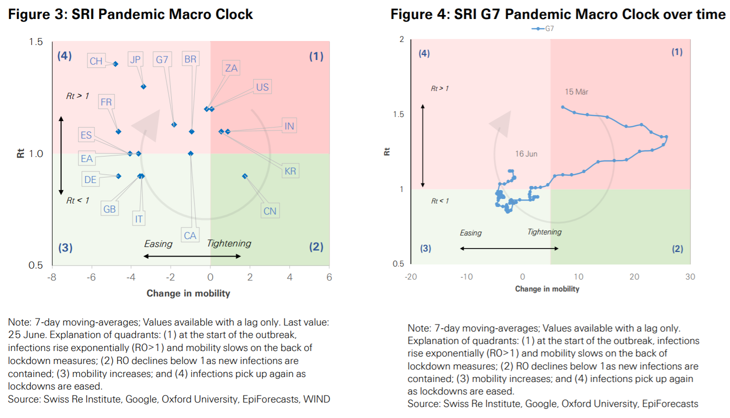

A resurgence of new infections exposes downside risks to the nascent recovery (see Figure 2), as major economies have now moved away from the sweet spot in our SRI pandemic macro clock ( see Figure 3- 4).

New cases spiked at the beginning of July in the US and several emerging market economies, while concerns about second waves have also increased in Asia and Europe, where several countries have seen local outbreaks.

As a result, various US states and municipalities have halted or even reversed reopening measures, and targeted local lockdowns were introduced in the UK and Germany.

After a strong initial rebound, we expect the global economic recovery to be protracted with risks skewed to the downside.

Government stimuli have provided the much-needed support in 2Q20, but some of the measures are now fading out.

While USD 11 trn of fiscal measures have already been announced worldwide, we expect some further economic stimulus measures to be passed in 3Q20 in the US and the UK, with about 4-5 per cent and 1 per cent of GDP, respectively.

Meanwhile, the EU is expected to agree on the details of the proposed recovery fund package over the summer.

Should policymakers, however, fail to act, this would add further downside risk to our projections.

Recession risk for China remains stable as the economy is firmly on its recovery path with capacity utilization having resumed to over 95 per cent of pre-COVID-19 level.

Weakened global demand, rising tension with the US and soft global business sentiment are seen as the major headwinds.

Strong fiscal support estimated at ~6 per cent of GDP in 2020, with a key focus on enhancing growth potential through market-oriented reforms, should help to limit downside growth risk.

Key to watch: Progress on Phase 1 trade deal, US sanctions and dispute, financial flows.

Given the sharpness of the economic downturn, credit markets are facing the risk of elevated downgrades and higher defaults in the coming months.

Corporates in certain industries (e.g., oil sector, SMEs) and emerging markets are under increasing pressure.

Monetary easing and low interest rates could mitigate some of the risks. It might nevertheless be necessary to set up bad banks to absorb high risk assets, particularly in Europe, and to make use of equity infusion programs to lower risks.

Key to watch: Earnings releases, corporate credit spreads, restructuring/ default rates announcements.

Monetary policy will be deployed further to combat the uncertainties from COVID-19.

Although this is unlikely to offset the drag on economic activity, it could avoid excessive tightening of financial conditions.

However, increasing "financial repression" and potentially even eventual debt monetisation to accommodate the massive fiscal stimulus will increase longer-term risks associated with a loss in central bank credibility.

Key to watch: 16 July: ECB meeting, 29 July: Fed meeting, 6 Aug: BoE meeting.

The bilateral relationship between US and China has deteriorated again, and achievement of Phase 1 milestones is in question.

The Chinese decision to impose the national security law on Hong Kong has inflamed tensions further. Political rhetoric in the US is likely to escalate in advance of the presidential election in November.

Additionally, the US has initiated an investigation into digital taxes across a number of countries, including the EU.

Key to watch: Limits on Chinese 5G and tech companies, medical supplies; tariff developments; progress on US-China Phase 1 implementation; digital taxes.

Several conflict areas are present in the EU, incl. migration policy, national budgets, and the rule of law.

The initial lack of cross-country crisis coordination exacerbated the divisions across the EU. The recent proposal for a common EU fiscal response is a significant positive step and we think it is likely to be passed in the summer.

Key to watch: 17-18 July: EU special summit, Coronavirus government responses, Migration developments, ECB/EU Commission agenda under new leadership.

Immediate inflation risks are very low since the demand shock from the coronavirus is likely to outweigh the supply shock in the short run. Lower oil prices are also pushing inflation down in the short-term.

However, beyond 12 months, medium-term inflation risks from a sustained supply shock have increased given the unprecedented fiscal stimulus and potential monetisation of debt.

Key to watch: OPEC+ communication, 17 July: Eurozone HCP, 31 July: US PCE , 12 Aug US CPI.

Stronger growth (than baseline) could come from a swifter-than-expected end to the coronavirus spread and an earlier lifting of containment measures, together with a swift and coordinated monetary and fiscal response across countries resulting in a V-shaped recovery.

A medium-term resolution of the US-China trade disputes and tariff roll-back would also be an upside risk.

Key to watch: Credit impulse, timing of lock-down end, real interest rates, G20 coordination.