@WikimediaCommons.

@WikimediaCommons.

The UK’s May announcement of a 20-year project to boost national growth and enhance its place in global Artificial Intelligence (AI) markets – with a £100 billion investment in semiconductor procurement – has seen investors weighing in on the viability of the asset class.

With all the hype surrounding ChatGPT, cryptocurrency, and tokenisation in general, insurance investment teams seeking to match long-dated liabilities should remember that AI is a broad field – and some segments are more mature than others.

Stable opportunities will likely crop up in these areas first, and it’s important to separate the wheat from the chaff.

When UK Prime Minister Rishi Sunak announced his National Semiconductor Strategy this spring, advancing growth in domestic chip firms across the country was the major objective.

“Up to £1 billion of government investment will boost the UK’s strengths and skills in design, research and development, and compound semiconductors,” said 19 May’s published paper. “This strategy sets a vision that over the next 20 years the UK will have a world leading position in the semiconductor technologies of the future.”

The three core goals of the plan were said to be, 1) growing the domestic sector, 2) mitigating the risk of supply chain disruptions, and 3) protecting UK national security.

Of course, the elephant in the room was the prevalent worry surrounding China’s current position in global semiconductor production.

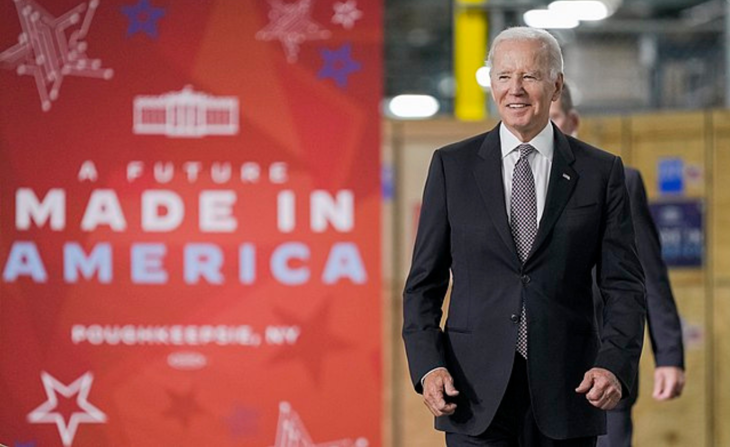

The US, meanwhile, put money where the concerns lie – with President Joe Biden’s 2022 CHIPS Act that sanctioned $280 billion to bolster US semiconductor capacity, catalyse research and development, and bolster regional high-tech hubs and a larger STEM workforce.

Localising semiconductor production – and wider AI innovation – is a growing national trend in the wake of strained relations with China. Earlier in August, Biden signed an executive order to begin enacting restrictions on US investment in Chinese sectors such as AI, quantum information technologies, and semiconductors.

Back in June, at the Insurance Investor Live | Midwest event, Eric Cantor, former House Majority Leader (R), House of Representatives, United States Congress, and Vice Chairman and Managing Director at Moelis & Company, told Insurance Investor that his “main concern” was “what [would] happen with global trade [and] the relationship between the US and China.”

He said he was also worried about costs associated with supply chain restructuring, which he predicted as increasingly common in years to come. “When you think of the enormity of trade [between] the US and China, about $2 billion is transacted daily. It’s mind boggling to think [the US] would just give up this capital,” he said.

Meanwhile, California-based semiconductor designer Nvidia has just seen its stock prices hit an all-time high. The company, often referred to as the US’s new “AI darling”, announced successful Q2 results this week after an impressive Q1, with numbers tripling in value in H1 2023 alone.

“Including AI exposure in investment portfolios isn’t just a trend.”

Nigel Green, CEO of the independent asset manager and financial advisor deVere Group, said that whilst he believes the “hype” surrounding Nvidia and their H1 2023 earnings is “dangerous”, all investors should consider additional AI exposure. “As the AI market continues to expand and evolve, investors who recognise its potential are well poised to reap the rewards,” he added.

“Including AI exposure in investment portfolios isn’t just a trend,” were his words of advice. “It’s a strategic move that aligns with the future of innovation and economic growth.”

This was due to the market’s “robust fundamentals” and “future-focused” outlook. As a growth strategy, it has also been proven to reduce risk, ease volatility, capitalise on turbulent market conditions, maximise long-term returns, and shield against unforeseen black swan events.

Cantor said he believed that the Covid-19 pandemic had prompted an unignorable mentality shift in global relations – particularly those with China, which has long been in an ongoing ‘tech-war’ with the US.

“Supply chains are going to be less global, [and] security questions

around China will complicate global business.”

“After the pandemic, people woke up and said, ‘how is it we’re relying on countries like China, that don’t have our best interests at heart, for critical supply chains’. That’s why you saw Congress step up and incentivise supply chain restructuring; it was a reaction to a recognition of vulnerability,” said Cantor.

“Supply chains are going to be less global,” he predicted. This means that costs will increase due to the current regional focus. He forecast that, as a result, there will be a windfall for localised, consolidated manufacturers. “Security questions around China will complicate global business,” he continued.

For insurance investment teams, the potential boon to local manufacturing within tech and AI production means new opportunities on the horizon.

However, scrutiny is still necessary – especially as regulatory developments around AI markers continue to solidify.

Ryan Pannell, CEO and Global Chair of Kaiju Worldwide, an asset manager focused on providing access to AI-powered investment products, said he was hopeful about openings in the arena.

The clamour around AI investing was not overstated, he added – unlike, he believed, other recent examples of overhyped technologies, such as NFTs and other tokenised assets. “AI represents real, tangible value across almost every business sector,” he said. “From healthcare, to transportation, to finance, there are numerous applications.”

Pannell noted that AI excelled particularly at creating new efficiencies – by enabling repetitive tasks to be completed in quicker, more streamlined manners. This, he said, made “thematic investing in AI something definitely worth considering”.

“AI represents real, tangible value across almost every business sector.”

Drilling down into some of the fund management details, he continued that there were clear benefits from AI regardless of asset class or underpinning ideology, and investment teams would be naïve to look away now.

There were varied uses, too. “Whilst a fund focused on global macro or volatility arbitrage may use AI only as a filtering and culling mechanism – which is to say, very light AI use – funds focused on systematic investing will use it almost exclusively,” he added.

However, there are concerns. For one, the eventual lack of available energy and the dwindling of raw materials will make new developments increasingly difficult, said Pannell.

He added that the “bigger, better” mentality that many have around AI was not sustainable – and would get investors that pursued growth without taking nuances into consideration into hot water.

Regulation could also be a thornier point. Always evolving based on perceived threats, Pannell said he felt that AI regulatory frameworks would take longer to develop than many thought. Then came implementation – also a potentially tricky stage.

But, according to Pannell, investors could still expect rapid growth in capital deployment opportunities as regulatory regimes settled, especially around chip technologies and out-of-box systems. A main goal of such frameworks would be substantially cutting proprietary development times, he continued – which are often a major headache for investors seeking to match shorter-dated liabilities.

Still, many experts are worried. A May New York Times analysis on the dangers of AI found that one of the most pressing concerns was the prevalence of “untruthful, biased, and otherwise toxic information” – not to mention job loss and the environmental toll.

However, Pannell was quick to remind that many of the well-known issues with AI – or, at least the ones that give investors pause – are more nuanced than they initially appear.

He urged investors to consider the fundamental difference between generative and predictive AI. The former encompasses things like ChatGPT, and is still in early phases, whilst the latter is based on machine learning and is currently more reliable – often used for end point investment management decisions.

“Generative AI is accessible and impressive in capabilities, but currently all generative AI suffers from challenges,” said Pannell. These include key concerns like the lack of critical sources and human oversight, plagiarism, corrupt data, and overall manipulability.

Predictive AI, on the other hand, said Pannell, “does not share most of these challenges”.

“It’s not that generative AI is bad and predictive AI is good [but] that they

have different strengths, weaknesses, and risks.”

He added that investors looking to the artificial intelligence sector for growth opportunities should weigh the specifics carefully. “The two most important questions anyone considering an investment in AI should ask are, 1) what type of AI is it?, and 2) what has it been designed to do?,” he said.

A helpful analogy was that of tokenised assets, including cryptocurrency and NFTs – which are not comparable, said Pannell. “From Bitcoin to Dogecoin to Bored Ape NFTs, you wouldn’t say that all tokenised assets were created equal. The same goes for AI.”

When asked if there was an ideal ‘workaround’ for investors interested in AI markets but concerned about their immaturity, Pannell said that “better education” was needed – especially around unavoidable limitations.

“If we can collectively work in support of better education for the general populace in terms of what AI actually us, what it does, and what its limitations are, then [we will have] a better educated investing public [that can] determine which AI they’re interested in considering for investment.”

At the same time, he said, increased knowledge around inherent risks is also critical. “It’s not that generative AI is bad and predictive AI is good [but] that they have different strengths, weaknesses, and risks,” he continued.

“Diversification is, as ever, investors’ best tool for long-term financial success.”

For his part, Green advocated for caution. “Just [invest] judiciously,” he said. AI represented a potential reshaping of all industries – and investor portfolios, as a result – however, it should not exclusively dominate allocation strategies.

“Diversification is, as ever, investors’ best tool for long-term financial success,” he continued. “[AI] is not a panacea.”

Additional AI allocation certainly won’t solve all of investment teams’ problems – but it does seem to be a market segment that is here to stay. Insurance organisation shouldn’t turn their backs.