@Pixabay.

@Pixabay.

Insurance-linked securities (ILS) has proven complementary to an array of insurance companies’ existing allocation categories.

Many liability-driven investors allocate to ILS as an efficient lever for income generation and diversification within the regulatory constraints they operate. Depending on investor-specific risk and liquidity preferences, various ILS access points and structures are available, including Cat Bonds, sidecars, collateralised reinsurance and ILS funds managed by specialist investment managers.

Inflation uncertainty and the increasing correlation between debt and equity returns have led many investors to seek further diversification through alternative investments, and for some, an allocation to ILS has proven to provide this added diversification while also complementing existing investments

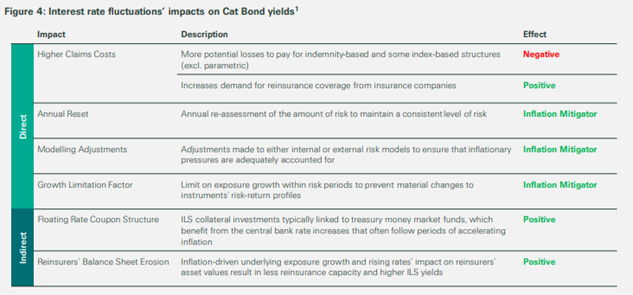

Inflation is a key concern for the property insurance industry due to the direct and adverse impact of rising costs of goods and services on the value of claims, which increases insurers’ need for risk capital (sourced either through raising equity, issuing debt or purchasing reinsurance) to comply with regulatory capital requirements.

This inflation-driven demand growth for reinsurance and other forms of risk capital (such as ILS) leads to reinsurance and ILS price increases that can outpace inflation’s impact on the cost of claims, increasing ILS market spreads for new issuances, and potentially improving ILS modelled returns.

In addition to price increases, many ILS instruments have structural components that mitigate the adverse effects of unanticipated rises in inflation, such as:

• Annual resets: The underlying exposures of multi-year ILS transactions (such as Cat Bonds) can change year over year due to inflation’s impact on insured values, a sponsor’s business growth or other reasons. Annual resets reassess the transaction’s risk and ensure that investors are compensated for material risk-return profile changes

• Growth limitation factors: Between annual resets, a transaction’s underlying exposure growth is limited, usually to 10%, to mitigate the potential impacts of inflation or rapid business growth on a transaction’s risk profile. If the sponsor exceeds this limit, potential losses incurred by the instrument are scaled back

• Floating rate coupon structure: Many ILS transactions are fully collateralised, with the collateral often invested in short term money market funds. As central banks tend to increase interest rates during inflationary periods, ILS investors gain a natural hedge against eroded real returns.

ILS is viewed as a long-term investment for many investors. Although a 10% allocation may make sense from a theoretical (mean-variance) approach, the average allocation is generally smaller, as some investors are cautious of the asset class’s modelled tail risk or are not yet familiar (and therefore uncomfortable) with the asset class’s esoteric nuances.

Depending on investors' objectives and liquidity preferences, many access points are available that can complement existing allocation categories. Specifically, many have chosen to place ILS allocations within their alternative fixed income or hedge fund portfolios, depending on the structure invested within and whether an investor participates directly in ILS transactions or through specialised investment managers.

Regardless of access point or allocation categories, the asset class's diversification benefits, resiliency to macroeconomic contexts and attractive risk-return profile can make ILS an important long-term addition to institutional portfolios.

Important Disclaimer

This information is provided by or on behalf of one or a combination of Swiss Re Capital Markets Corporation ("SRCMC"), Swiss Re Capital Markets Limited ("SRCML") and Swiss Re Capital Markets Europe S.A. ("SRCME") (together, "SRCM"). SRCMC is a member of the Financial Industry Regulatory Authority ("FINRA") and the Securities Investor Protection Corporation ("SIPC"), and is regulated by the FINRA. SRCML (Financial Services Register Number 187863) of 30 St Mary Axe, London, EC3A 8EP, is a company authorized and regulated in the conduct of its investment business in the UK by the Financial Conduct Authority ("FCA") and entered in the Financial Services Register. The FCA's website http://www.fca.org.uk/ contains a wide range of information of specific relevance to UK clients and provides access to the Financial Services Register. SRCML is registered as a foreign company in Australia with the Australian Securities & Investments Commission (ARBN 166 095 567). SRCML is exempt from the requirement under the Corporations Act 2001 (Cth) (the "Act") to hold an Australian Financial Services Licence in respect of any financial services provided to you. SRCML is regulated by the FCA under the laws of the UK, which laws differ from Australian laws. In addition, for the purposes of sections 925A(3) and 925A(4) of the Act, SRCML is informing you that it does not hold, and has never held, an Australian Financial Services Licence. This material is intended for Australian wholesale clients only (as that term is defined in section 761G of the Act) and is not intended for distribution to, nor should it be relied upon by, retail clients. SRCME, registered with the Luxembourg Trade and Companies Register under number B228476, having its registered office at 2, rue Edward Steichen, L-2540 Luxembourg, is a company supervised in Luxembourg by the Commission de Surveillance du Secteur Financier ("CSSF") and the Commissariat aux Assurances ("CAA"). SRCME operates a branch in Germany that is registered in the German Commercial Register (Handelsregister) under number HRB 294913 and subject to the oversight of the German Federal Financial Supervisory Authority ("BaFin"). SRCME German branch is required to comply with applicable German regulations for branches of foreign financial institutions, including anti-money laundering (AML) obligations. The CSSF's website (http://www.cssf.lu) and BaFin's website (http://www.bafin.de) each contain a wide range of information of specific relevance to Luxembourg and Germany clients, respectively, and provide access to the register of supervised entities in either jurisdiction. This information is only intended for eligible counterparties or, in the case of persons based in the USA, institutional investors. Persons who receive this communication who are not eligible counterparties or, in the case of persons based in the USA, institutional investors, should not reply or act upon its contents. Persons dealing with SRCML outside the UK are not covered by all the rules and regulations made for the protection of investors in the UK, and may not have the right to claim through the UK's Financial Services Compensation Scheme.

More generally you are reminded that this material has been delivered to you on the basis that you are a person into whose possession this material may be lawfully delivered in accordance with the laws of the jurisdiction in which you are located or other applicable jurisdictions and you may not, nor are you authorized to, deliver this material to any other person. The information is confidential and proprietary to us and is solely for your use. By receipt of this information, you acknowledge and agree that the information contained herein may not be reproduced or circulated without our written permission and may not be distributed in any jurisdiction where such distribution is restricted by law or regulation. SRCM is providing these materials solely for the purpose of providing information that may be useful in analyzing the markets and products discussed herein; however, the information should not be construed as legal, tax or investment advice nor interpreted as recommending any investment in any particular product, instrument or security and should not be relied on as the sole source of information upon which to base an investment decision. Recipients should request any additional information they deem necessary or desirable in making an informed investment decision. Neither SRCM nor any of its affiliates can accept responsibility for the tax treatment of any investment product, whether or not the investment is purchased by a trust or company administered by SRCM or an affiliate. SRCM assumes that, before making a commitment to invest, the investor (and where applicable) its beneficial owners have taken whatever tax, legal or other advice the investors/beneficial owners consider necessary and have arranged to account for any tax lawfully due on the income or gains arising from any investment product provided by SRCM.

No representation is given to any investor regarding the legality of an investment or service. Unless otherwise agreed in writing, SRCM is not acting as your financial adviser or fiduciary and the solutions described herein, are only one way in which you may want to transfer risk. There may be other financing alternatives available to you by other Swiss Re Group companies. The information contained in these materials was obtained from sources believed to be reliable and any discussions reflect the views and judgment (including illustrations, estimates, opinions, forecasts and projections), of the party or parties that prepared it as of the date hereof and is subject to change. No representation is made as to the accuracy or completeness of such information or that all assumptions relating to them have been considered or stated or that such projections or returns will be realized. The returns or performance results may be lower than estimated herein. Any opinions expressed in this material are subject to change without notice and SRCM is not under any obligation to update or keep current the information contained herein. You hereby unconditionally agree that SRCM is not responsible to you for any of the information or content herein and that any use you make of this information is totally your own responsibility and at your own risk. Any decisions you make to invest in the securities, instruments or services discussed in these materials will be based solely on your own evaluation of your financial circumstances, investment objectives, risk tolerance, liquidity needs and any other factors that you deem relevant. Any distribution of securities arising out of the solutions described herein is intended to be marketed and placed to sophisticated investors who, from the perspective of the United States Securities Act of 1933, would meet the definition of Qualified Institutional Buyers. Certain statements contained herein constitute “forward-looking statements”, which may include, among other things, projections, forecasts, predictions and sample or pro forma calculations. These forward-looking statements are based upon certain assumptions which may not be stated herein and assumptions which are inherently uncertain and unpredictable, and no representation or warranty is made as to the accuracy of any forward-looking statements. Actual events may differ from those assumed. All forward-looking statements included herein are based on information available on the date hereof (including certain economic, monetary, market and other conditions in effect on the date hereof) and none of SRCM or its respective affiliates assumes any duty to update any forward-looking statement or revise any portion of these materials based on circumstances, developments or events occurring on or after the date hereof. Accordingly, there can be no assurance that estimated returns or projections can be realized, the forward-looking statements will materialize or that actual results will not be materially different than those presented.

Legal notice

©2024 Swiss Re. All rights reserved. You may use this presentation for private or internal purposes but note that any copyright or other proprietary notices must not be removed. You are not permitted to create any modifications or derivative works of this presentation, or to use it for commercial or other public purposes, without the prior written permission of Swiss Re.

The information and opinions contained in the presentation are provided as at the date of the presentation and may change. Although the information used was taken from reliable sources, Swiss Re does not accept any responsibility for its accuracy or comprehensiveness or its updating. All liability for the accuracy and completeness of the information or for any damage or loss resulting from its use is expressly excluded.