This treatise on asset management in an ALM context has four parts: (1) problem description, (2) method to solve it, (3) some solutions and (4) messages from the solutions. Part (2) presents a new and simple approach that allows insurers and pension funds to evaluate and test asset allocations. Together with part (4) it constitutes the gist of this work.

Life insurers and pension funds have decades-long liabilities requiring payments that, disregarding new business, are known in time and value and that are barely affected by market conditions.

These payments are illiquid. Therefore only the cashflows that are due matter, and not their present value.

To guarantee these payments under all market conditions and along the way optimally reward stakeholders one needs a clear view on the risk and reward over the whole runoff that an asset allocation or its alternatives entail.

"Return expectations are needed over such a long term that they

better change over time with changing market conditions."

Evaluating allocations requires a trade-off between the return over the whole runoff and the risk of running out of assets before all dues are paid, and this while continuously abiding hard regulatory constraints and softer constraints like risk appetite and pressure not to stray too far from peers.

Over the runoff, maturing assets need to be replaced and allocation weights rebalanced. Resilience to stress scenarios can be required besides remaining solvent given the risk implied by the covariance risk description(s).

Return expectations are needed over such a long term that they better change over time with changing market conditions. Even for a stable allocation with known liabilities many variables interplay and comparing multidimensional quality measures is tricky.

We propose to condense the whole runoff process into a single expected return and risk measure akin the return and risk that asset managers attribute to assets.

Different allocations, different assumptions and different stress-scenarios are then easily mapped to such a return and risk measure that asset managers area used to cope with.

The measure needs to remain constant over the whole runoff. The annual (gross) return is the capital that each year can be extracted from the assets to the stakeholders and that is then no longer available to pay liabilities.

"We propose to condense the whole runoff process into a

single expected return and risk measure."

By extracting each year the same fixed percentage of remaining liabilities, called FixPct, the ratio of assets/liabilities remains constant over the whole runoff.

Return measure FixPct depends mainly on the asset assumptions, on the allocation, on the pattern of the liability payments and on the initial surplus of assets over liabilities.

FixPct or FixPctP50 is the percentage if all assets perform as on average expected, or said otherwise, if assets deliver the return halfway (at 50 per cent) their probability distribution, called Probability 50% or P50.

"This cashflow runoff framework allows for clear and robust

investigation of the economic long-term risk"

FixPctP5 is the extraction percentage at P5, so if the one in twenty worst expected market outcome for the runoff realises. Mapping FixPctP0.1 to FixPctP50 shows a nearly normal distribution for FixPct with standard deviation StdPct. FixPct and StdPct then capture the essence of the runoff.

We model long-term expected returns of the assets as a constant spread plus an interest rate contribution. Forward interest rates are either market data at some date or assumptions with shocks at some moment. Risk is modelled by the usual covariance framework.

This cashflow runoff framework allows for clear and robust investigation of the economic long-term risk and the flexibility that the company has for capital management and non-liability related expenses.

Dependency on underlying assumptions, on market risk, on market shocks, on allocation modifications or on changes in liabilities can easily be mapped and evaluated in their long-term perspective.

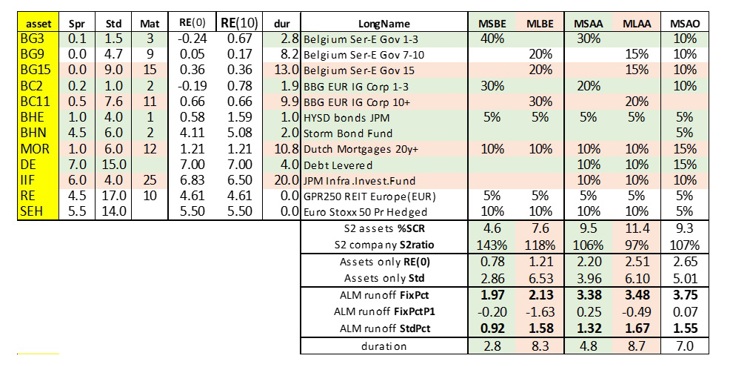

Example allocations MSBE and MSAA contain mainly short duration bonds, MLBE and MLAA longer duration.

MSBE and MLBE hold classic insurance assets, MSAA, MLAA and MSAO have more alternative assets. MSAO is more diversified.

Asset expected return RE(T) = Spread+Swaprate(Maturity,T) and risk is Std. RE(10) for BG15 is still 0.36 because it is not yet reinvested in year 10. For correlations, forward swap rates and other assumptions refer to the full text.

For these allocations %SCR is the estimated “Asset Solvency Capital Requirement” as percentage of assets for the Solvency II standard model.

The Interest Rate cost for the duration gap of short allocations is usually much smaller than the Spread cost for long corporate bonds.

For the Solvency II Ratio S2ratio only the relative values matter because their level depends on assumptions on the business.

RE(0) and Std are the classic assets only expected return starting from T=0 and the standard deviation of annual returns from the covariance matrix. FixPct, FixPctP1 and StdPct are the ALM runoff return and risk measures presented above for linearly decreasing liabilities over thirty years with duration around 10 years, and an initial surplus of 7.5 per cent of liabilities.

The higher StdPct and the negative numbers for FixPctP1 show that longer duration allocations are economically more risky. Solvency II wise the shorter allocations are cheaper and S2ratios higher. MSAA and MSAO are economically much safer than MSBE but have much lower S2ratio.

Statistics above and from cases described in the full text imply the following.

In current market conditions risk is materially reduced by reducing asset duration by diversifying into higher yielding assets, irrespective of the pattern of the liabilities.

Return benefits from shorter duration in most market scenarios and, when not, the benefits of longer duration are small compared to their drawbacks in most scenarios.

Diversify for instance into Private Debt, Mortgages, High Yield Short Duration bonds, Infrastructure Investment Funds, Trade Finance and other higher yielding diversifying assets from the proceeds of selling long term Investment Grade bonds or Government bonds to the extent that the Solvency II ratio allows.

Duration reduction by swaps is of no avail because not duration itself is the problem but the insufficient yield of long-term Investment Grade and Government bonds.

"For insurers another message is that the Solvency II Ratio

is misleading to evaluate risk."

Mark that this suggestion to reduce duration is not due to the expectation that rates will rise but based on symmetrical market expectations.

The fact that core European real interest rates for long maturities are materially negative, and that historical data suggest that the risk of large rate moves is skewed upwards, only add to the argument.

For insurers another message is that the Solvency II Ratio is misleading to evaluate risk.

By ignoring asset returns and by its short term view this ratio is currently negatively correlated to the real long-term economic risk for a given company. This means that an asset allocation optimized for a lower Solvency ratio is economically less risky in the range of reasonable ratios.

"Another advantage of short duration allocations

is their flexibility."

The misperception that a high Solvency ratio and duration matching reduce risk stems from the artefact of considering liabilities as liquid and potentially due at any moment. This is what the use of their present value discounted by swap-rates in quarterly Solvency reporting effectively implies.

Furthermore the Solvency ratio is deficient as indicator for runoff risk because Solvency II is return agnostic whereas over the longer term higher returns more and more outweigh risk. Over the whole runoff period diversified and sufficient returns are the most effective risk mitigator.

Another advantage of short duration allocations is their flexibility to adapt to changing market environments.

Besides the misperception that duration matching reduces ALM risk insurers also hold on to long term bonds to reduce P&L volatility or to manage shareholder expectations more easily.

This is very costly over the runoff and there are mitigating remedies. Performing the full quantitative analysis of the runoff learns how costly and this knowledge is a prerequisite to manage wisely.