@Pixabay.

@Pixabay.

In recent years, investors have turned to insurance linked securities (ILS) to further diversify their portfolios while potentially improving risk-adjusted returns, particularly in the context of an uncertain inflationary environment and elevated correlations between debt and equity markets.

By allocating to the ILS market, investors can benefit from an alternative source of income that is driven by distinct factors relative to more traditional financial markets, often resulting in improvements to institutional portfolios’ modelled and historical return metrics.

Specifically, ILS allocations can improve an investor’s risk-adjusted returns by providing significant diversification benefits at attractive yield levels. These benefits have been most apparent during times of high volatility (e.g. 2008 Global Financial Crisis and 2020 Covid-19 Pandemic), where ILS has proven resilient to broader economic stresses and provided a stabilizing force for multi-asset portfolios.

Various ILS access points and structures are available, including cat bonds, sidecars, collateralized reinsurance and ILS funds managed by specialist investment managers.

Many investors, particularly liability-driven institutions such as pension funds, have viewed allocations to ILS as a mechanism to better achieve their long-term investment objectives.

Insurance companies can benefit from asset allocation to ILS as an efficient lever for income generation and diversification within the regulatory constraints they operate.

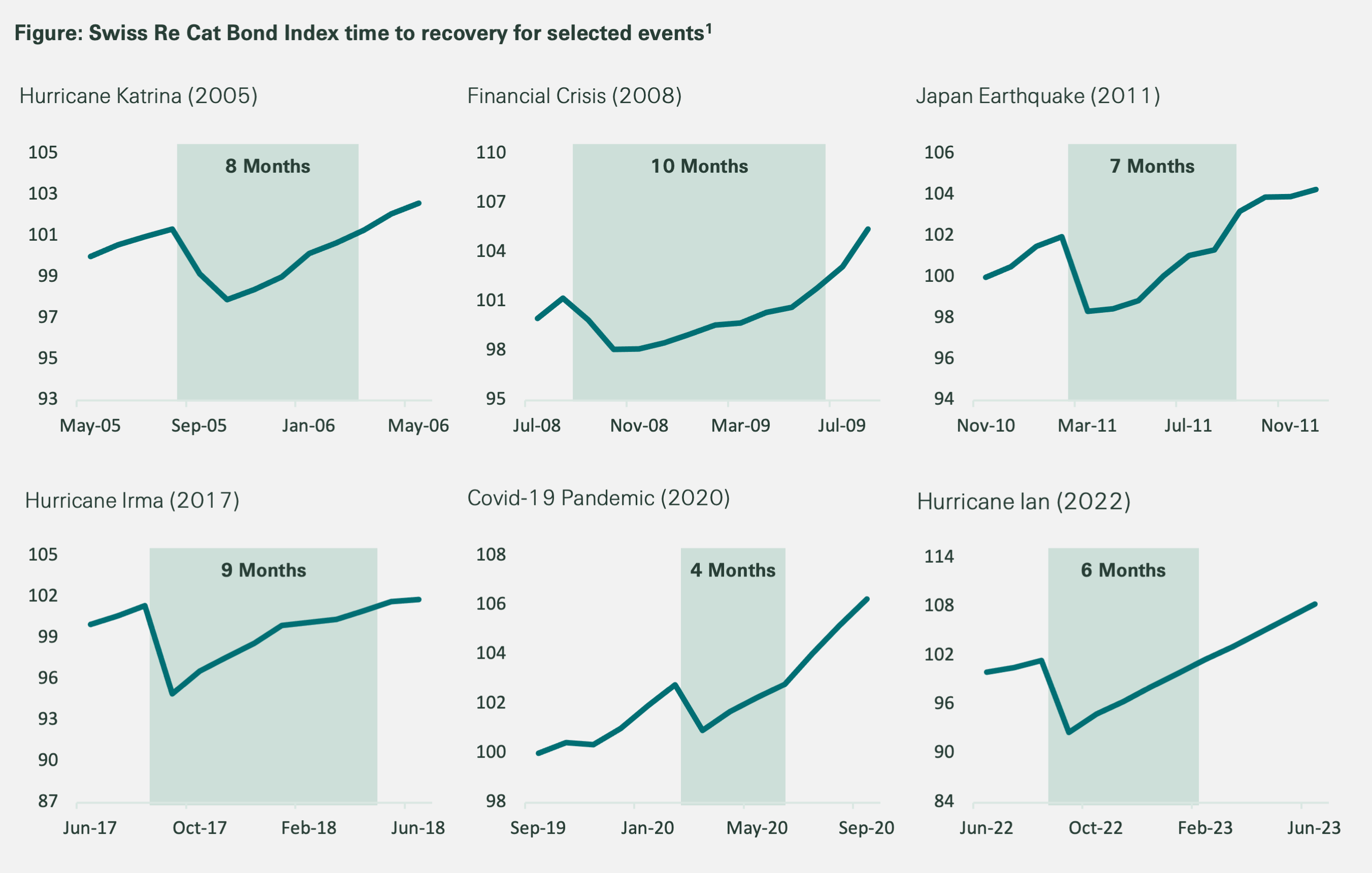

Since its inception, the ILS market has displayed resiliency to both macroeconomic and reinsurance market-related stresses, with the Swiss Re Global Cat Bond Total Return Index (“Swiss Re Cat Bond Index”) delivering positive monthly returns 89.5% of the time since its inception in January 2002.1 Following drawdowns, which are most frequently caused by significant natural disasters, ILS has recovered rapidly relative to other asset classes and often sustained outperformance post-recovery.

This post event outperformance has been driven by catastrophes’ impact on increasing demand for reinsurance protection whilst decreasing reinsurance capacity, resulting in elevated reinsurance rates and more comprehensive structural protections for ILS investors.

This resiliency was most recently highlighted following Hurricane Ian, where the Swiss Re Cat Bond Index recovered to pre-Ian levels within six months and returned 22.3% for the 12-month period beginning immediately after the event’s initial drawdown.1

Other examples of ILS performance through significant global events are displayed below, with the asset class's returns amidst the COVID-19 Pandemic and Global Financial Crisis further highlighting the diversification benefits provided by ILS.

1. Source: Swiss Re Capital Markets as of March 31, 2024.

I) ILS as a complement to alternative fixed income / credit

ILS instruments have structural similarities to fixed income products. According to Swiss Re Capital Markets, cat bonds comprise c. 40% of the ILS market (as of March 2024). They are traditionally structured as principal-at-risk floating rate 144A notes with 1 to 3-year terms with their modelled returns dependent on three main components:

Additionally, cat bonds are traded in a secondary market, providing liquidity levels in-line with some corporate bonds.

II) ILS alongside diversifying hedge fund investments

Dedicated ILS funds have grown in popularity due to the relatively high-yielding and uncorrelated risk-return profile to more traditional investments. Given their short duration nature, allocations can be viewed as a diversifying total return lever instead of an asset liability matching tool.

Investors primarily access these returns through funds offered by specialist investment managers due to the asset class’s unique characteristics and the reinsurance-based skillset required to underwrite structures’ underlying risks.

III) ILS as a standalone asset class

As a standalone asset class, ILS enable investors to develop a diversified ILS portfolio tailored to investment needs, take advantage of opportunities within the market, and foster deep knowledge of the asset class.

Regardless of access point or allocation categories, the asset class's diversification benefits, resiliency to macroeconomic contexts and attractive risk-return profile can make ILS an important long-term addition to insurance investment portfolios.