@MackayShields.

@MackayShields.

Despite recent favourable inflation trends, yields across the bond market remain elevated, hovering around 10-year highs. Increased bond yields and lower prices are often related to an increase in perceived market risk. This backdrop begs the question: how should fixed-income investors position their portfolios in today’s market environment?

With a late cycle economy and sticky inflation, investing in higher credit quality fixed income bonds, while locking in yields for durable income, may be rewarding in the longer term.

While most investors are familiar with tax-exempt municipal bonds, their taxable counterparts are often overlooked. Based on market size according to Bloomberg, 20% of the $4 trillion municipal bond market are taxable issues, often the same entities that issue in the tax-exempt space. Over the past several years, taxable municipals have gained traction among US institutional investors, particularly insurers. The attraction is fuelled by the potential benefits they offer.

77% of taxable municipal bonds are rated AA or higher, contrasting with 9% of global investment grade corporates.

Source: Bloomberg as of July 31, 2023. Taxable Municipals represented by ICE BofA Broad US Taxable Municipal Securities Index (TXMB). Global Corporates represented by Bloomberg Global Aggregate Corporates Index. It is not possible to invest directly in an index. Please see disclosures and index descriptions at the end of this document.

Soaring US Federal budget deficits (nearing $2 Trillion) and significant increases in overall debt to GDP (35% in 1980s versus nearly 125% today) have put US Treasury debt at risk for a possible downgrade by Moody’s Investor Service. In contrast, most US states have a constitutional requirement to balance their budgets and have maintained steady leverage metrics over the past decade.

Historically, municipals have experienced lower ratings volatility when compared to corporate bonds.

These higher credit quality borrowers with monopolistic characteristics have dedicated cash flows which help drive repayment consistency on debt service. This contrasts with corporate bonds, where most cash flows are unsecured, creating less payment certainty.

Source: Bloomberg

In eight of the last ten years, taxable municipals have outperformed the Bloomberg US Aggregate Index (Aggregate). As of September 2023, municipals outperformed the Aggregate year-to-date by 209 basis points (bps) (Source: Bloomberg).

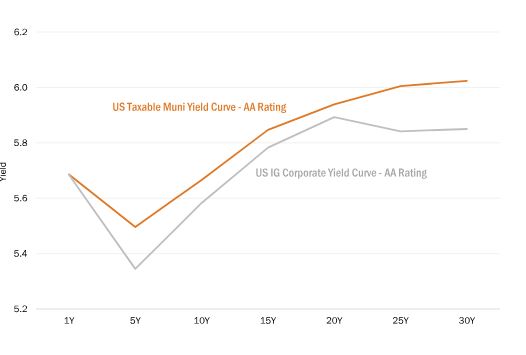

In contrast to investment grade corporates, an allocation to taxable municipals can offer higher yields and achieve positive roll-down effects. This allocation may also boost total return and provide a cushion in the event rates continue to rise.

For insurers with longer-term investment horizons, tapping into attractive value opportunities at the longer-end of the curve may be beneficial. Expanding into taxable municipal bonds provides enhanced diversification via high quality bonds with the potential for appealing long-term returns.