@MacKayShields.

@MacKayShields.

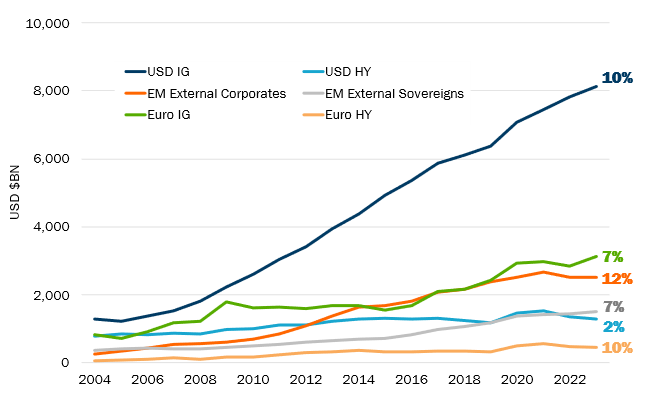

Emerging market debt has gained significant prominence over the last two decades, in both economic and financial spheres. The share of emerging market bonds within the global bond market was around 10% in 2004, whereas now it accounts for almost one third of the global bond market.[1] We submit that it is an asset class that cannot be ignored anymore.

Within emerging market debt, emerging market hard currency corporate debt has gained even more traction. Far from a mature asset class but no longer the new kid on the block, it currently stands at 2.5 trillion USD[2], and deserves attention when compared to peers such as US corporates and on its own right. It is the fastest growing fixed income segment over the past 20 years, and spans more than 60 emerging market countries and 700 issuers.[3] It offers a multitude of potential benefits across the fixed income space including diversification for resilient income opportunities and the ability to express sectoral themes to complement sovereign macro views. Furthermore, different sovereigns often have varying structural and cyclical drivers, offering further diversification. Finally, we see abundant alpha opportunities from bottom-up credit stories.

Figure 1: Asset Class Growth

[1] JP Morgan, August 2024

[2] JP Morgan, August 2024

[3] JP Morgan, August 2024

Emerging Market Corporate is one of the fastest growing segments in fixed income.

Source: JP Morgan, June 2024.

We believe emerging market hard currency corporate debt is an asset class well suited for long term investors that seek structural risk premium and superior risk adjusted returns.

If we divide emerging market (EM) corporate debt further into high yield (HY) and investment grade (IG) segments and compare it with developed market peers, we see that both EM HY and EM IG offer compelling yield pick-ups over their respective developed market (DM) peers, while the credit ratings are the same or similar between EM IG and DM IG and the credit ratings for EM HY are overall higher than DM HY.[1] If the combination of better credit ratings and higher yields sounds too good to be true, the yield pick-ups become even more compelling after adjusting for duration, as emerging market corporates typically have a shorter duration profile than their global and US peers. Regressions throughout time show that while the exact amount of yield pick-up changes, the fact that emerging market corporates offer stronger credit and duration risk adjusted rewards persists, evidencing structural risk premium that can be harvested by long term investors.[2]

[1] JP Morgan; ICE Data, Bloomberg, August 2024

[2] JP Morgan; ICE Data, Bloomberg, August 2024. Based on an analysis of emerging market and developed market indices as of 30th August 2024. See Figure 2. Does not represent any product or strategy managed by MacKay Shields LLC or its affiliates and should not be construed as such. Past performance is not indicative of future results.