@Pixabay.

@Pixabay.

The second half of 2024 could see improvements in market sentiments – according to a new report by Gallagher Re – despite a busy hurricane season predicted and effects on risk spread.

"There were near-record returns for reinsurers in 2023,

exceeding 20% ROE in many cases."

In their report, “Balance Maintained”, the reinsurers said that “reinsurance buyers experienced a more welcoming market at [1/7/2024] compared to recent years, and in many ways, this improvement was no surprise”.

“There were near-record returns for reinsurers in 2023, exceeding 20% ROE in many cases,” said the report. “The first quarter of 2024 has followed a similar trend, with up to a 12% improvement in combined loss ratios, helping to build reinsurers' capital base and confidence to deploy their capital.”

At the same time, nonlife insurance-linked securities (ILS) capital has grown to a record, driven by increased investor interest.

ILS saw a spike in interest last year after several years in the level doldrums. In recent years, investors have turned to ILS to further diversify their portfolios, whilst potentially improving risk-adjusted returns – particularly in the context of an uncertain inflationary environment and elevated correlations between debt and equity markets.

In the ILS section of the report, Gallagher Re said that 2024 would “be another record-breaking year of cat bond issuance, with issuance up roughly 41% year-over-year through May 31, 2024”.

They added that risk spreads have widened since February 2024, primarily due to a “robust pipeline” and, to a lesser extent, “forecasts for an active hurricane season as well as a catastrophe model changes”. In its report, Gallagher Re said that “risk spreads remain significantly below where they were one year ago”.

That active hurricane season could be key. Moody’s said last month that despite an “active North Atlantic hurricane season last year”, there was only one landfall in the US in 2023.

Idalia became the first major hurricane to make landfall in Florida’s Big Bend region and to impact the state’s north-western coastal area since the 1896 Cedar Keys hurricane.

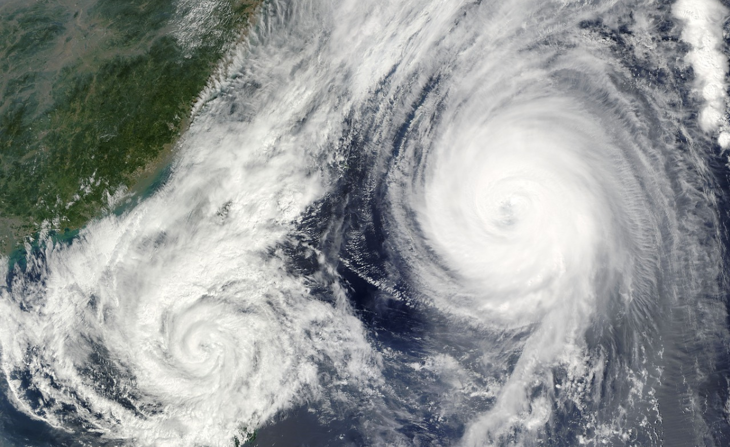

In 2024, according to the latest seasonal tropical cyclone forecasts issued by numerous meteorological agencies and groups, there is a strong consensus that the 2024 North Atlantic hurricane season is expected to be above average, with some forecasts suggesting a hyperactive season is not out of the question.

"More than 80% of cat bonds issued year to date have hurricane exposure,

a higher percentage than in the past."

Hurricane Beryl has, this week, become the first major storm of the season – leaving a trail of destruction across the Caribbean. Sea surface temperatures in the North Atlantic are at or near record warm levels across most of the tropical and eastern portions of the subtropical North Atlantic, and they are expected to remain at or near record levels throughout the coming months. Warmer sea surface temperatures typically result in a more active North Atlantic hurricane season, owing to the increased energy available for cyclogenesis and intensification.

“More than 80% of cat bonds issued year to date have hurricane exposure, a higher percentage than in the past,” said Gallagher Re’s report. “Secondary pricing on index-linked transactions widened out, along with a broader sell-off in the secondary market through the end of May, but then stabilised in June. ILS activity continues to accelerate outside of property cat with additional activity in Q2 in cyber cat bonds.”

However, Gallagher’s report also specified that “the predictions of a more active 2024 North Atlantic Hurricane season did not unduly influence core traditional reinsurers’ pricing. They also said that the industry’s capacity through some ILS capacity, [industry loss warranties] capacity, and retrocession capacity providers did moderate their appetite for US and Caribbean Catastrophe exposure.