@pexels

@pexels

Insurance-Linked Securities (ILS) can bring significant diversification benefits to investors, as the drivers of ILS spread movements and defaults, reinsurance pricing and the occurrence of natural phenomena, are fundamentally separate from the macroeconomic dynamics that impact other markets, being designed to cover peak natural perils and trigger after very high severity events such as major earthquakes and hurricanes. Being distinct from the economic and financial phenomena which drive more traditional markets, ILS is defined as a truly diversifying asset class.

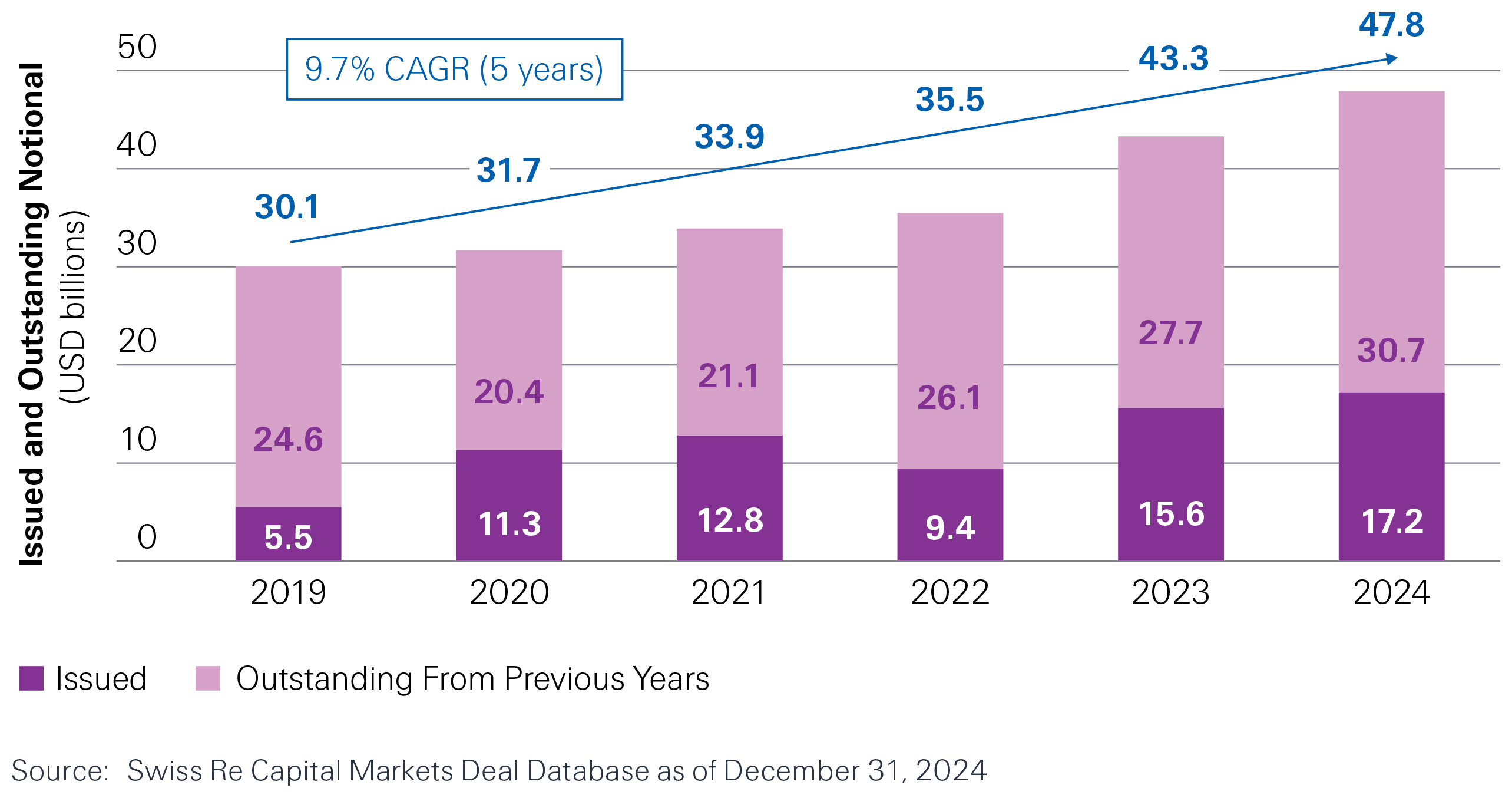

The ILS primary issuances observed during 2024 outpaced maturities by $4.7 billion and contributed to a 10.5% year-on-year growth of the total notional outstanding at the end of the year. The compound annual growth rate of the market over the last five years was 9.7%. Maturing capacity, coupon return, and large inflows have supported the growth of the market, which again saw a broad range of sponsors and perils covered through the issuance of 68 transactions.

As of early December, the Swiss Re Institute estimated the insured losses from both hurricanes to be almost $50 billion, yet their impacts on the ILS market have been minimal to date. Both hurricanes underscore the growing complexity of modelling hurricane risk, as Hurricane Milton highlights the importance of managing tail risks in Gulf Coast exposures, and Hurricane Helene emphasises the rising impact of water-related damages in the Northeast. Nevertheless, these events have not caused any direct losses to the ILS market, further demonstrating the resilience of the structures in place.

The Swiss Re Global Cat Bond Total Return Index posted a solid performance in 2024 with an annual return of 17.3%. The high level of demand from the investor base at the beginning of the year, fuelled by more than $3 billion of bonds having matured in January and coupon payments, led to a tightening of secondary risk interest spreads, contributing to a strong start of the year for the performance of the index. The rebalancing of cash observed during Q2 2024, with a strong issuance pipeline, led to a lower performance of the index across the second quarter, which added a return of 5.8% for the first six months of 2024. In the second half of the year, the lower-than-expected impact of Hurricanes Helene and Milton, the strong capital position and the benign loss activity across the first half of the year led to a global tightening of risk interest spreads on the secondary market. This created a positive mark-to-market, which, combined with the coupon returns, allowed the index to achieve a 10.9% return over the period.

Source: Data referenced in this article is sourced from Swiss Re Capital Markets, Insurance-Linked Securities Market Insights, Edition XXXVII, February 2025.